Trading Engine

From tick-by-tick backtest to live trading

Trade Equities, Forex, Options, Futures, Cryptos, and many other instruments using a centralized system.

Overview

Designed in an open and modular way by experienced market practitioners, the Systemathics Trading Engine Workstation provides high levels of expertise using cutting-edge technology, so you can automate your trading process.

Wide range of powerful features

- The Systemathics Trading Engine is well suited for fast-paced analysis of a larger number of instruments for daily, intraday and tick data, including full order book.

- It provides a complete set of exposure and performance measures, an accurate backtesting tool, smart orders, and technical indicators to bring your business to the next level.

- Its exceptional performance capabilities allow for both Low Frequency and High Frequency strategy backtesting, significantly improving the relevance of the tests.

- The backtesting tool simulates the full chain in the order workflow, including market impact and different exchange rule handling. It also allows you to export comprehensive post trade data sets for easy analysis using ubiquitous applications.

Trustworthy Event Driven Backtesting

Why does Systemathics Trading Engine use an Event-Driven approach?

Event-driven systems provide many advantages over a simple vectorised approach where the data would be loaded as one block:

- Prevents any Lookahead issue – Since the data is not loaded as a block but rather one event after another, it is not possible with such an event-driven approach to bias the backtest results when looking ahead.

- High volume processing – Loading the data event after event allows one to process large amounts of tick data, whereas a vectorised approach would fail to load the whole data set.

- Order management – Open architecture enables you to "drip feed" the back tester with market data to replicate as closely as possible how it would be handled by an order management and portfolio system.

- Code Invariance – The same code can be used for both real time trading and historical data backtesting with an event-driven platform. This is because by design, the platform only requires a continuous feed of events, rather than loading a whole dataset at once.

- Market Realism – An event driven approach is the most similar to market behaviour where orders are a succession of events that may require attention.

This event-driven approach allows our backtester to process large periods of time and generate signals as closely as possible as to how the market would.

If we combine this with the code invariance feature, we drastically reduce the operational risk thereby ensuring extra-trustworthy backtesting.

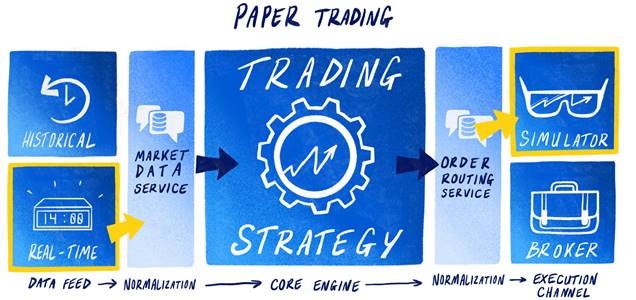

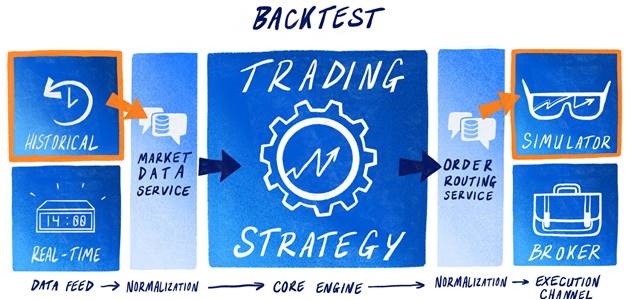

Innovative code-invariant approach

Systemathics Trading Engine allows you to accelerate your investment process and reduce production time thanks to our innovative and trustworthy code-invariant design.

This modular approach enables to see each different use-cases as services where you would switch from one scope to another simply by subscribing/unsubscribing to plug-ins on the market data side or execution feed.

By using the same source code for backtesting, paper trading and production or any custom scope, the positive impacts on your project lifecycle will be numerous:

- It will reduce the elapsed time for implementation.

- At the same time, the operational risk associated to a scope change will be diminished drastically since the core of the strategy will remain untouched.

Customizable approach using the Systemathics SDK

Systemathics Software Development Kit (SDK) provides you with an easy-to-use and standard development environment, enabling you to fully customize and to further extend the provided services.

Our solution is based on an open architecture and code-invariant approach which enables flexible and scalable integration. This allows you to integrate proprietary logic and third-party trade workflow components to pre-existing resources.

Connectivity management

Intuitive connector implementation to extend market access when required.

Strategy development

Proprietary strategies and execution algorithm development

User interfaces

User interface implementation and customization of provided GUIs

Seamless Integration

Open API and 3rd party library integration (C#, F#, C++, Java, R, Python, MATLAB…)

Analytics & Reporting

Bespoke performance indicator and post-trade analysis implementation

Ownership & Privacy

Intellectual property preservation and ownership of proprietary features