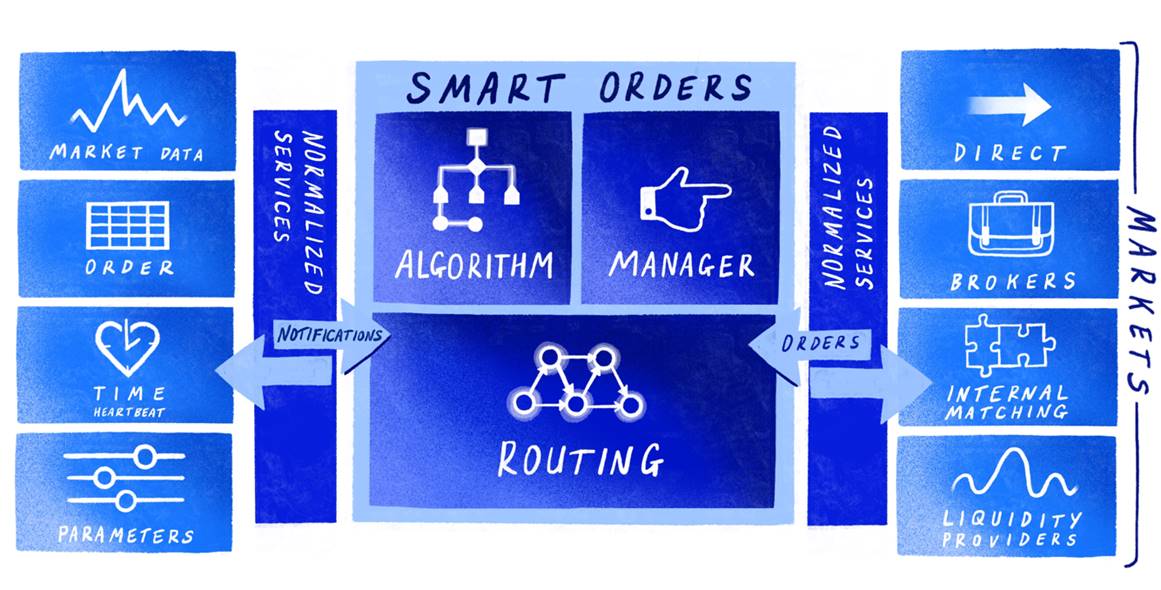

Smart Orders

Execution algorithms for tick-by-tick market data

Execute any orders in confidence and improve execution.

Overview

Smart Orders are the algorithmic order execution library designed to achieve high execution quality with consistent results.

Combine a rule-based trading process with the monitoring of real market data sources to generate a refined statistical signal in order to reach high execution quality.

What is an execution algorithm?

Execution algorithms are automated strategies integrated into the smart order routing service to handle the order execution in different markets.

They aim to solve several challenges:

- • Reach the best possible execution price.

- • Minimize market impact.

- • Allow privacy by preventing information leakage for large orders.

Flexible execution handling

Systemathics leaves the user the choice to use the native broker’s execution algorithm via the smart order routing service, or to use our library of execution algorithms.

We will always encourage the user to use the broker’s execution algos to improve the way they build their portfolio. However, the brokers or markets do not necessarily all provide smart execution algorithms, and furthermore, the algo does not always perfectly fit the customer’s needs.

Extensible and customizable execution algorithms

In addition to handling native brokers’ execution algorithms via the Systemathics smart order routing service, we also provide native and ready to use library of execution algos - like vwap or iceberg - for the execution of larger orders to minimize the impact on the market price.

All the provided algos are customizable; users can select the best parameters depending on their needs and strategies. They can also adapt and customize the algo itself by adjusting its routine.

For advanced customers, they will be able to design their own execution algo inside the smart order routing service.

How do Systemathics execution algos differ from those of brokers?

Our execution algos have similarities with those of brokers on tactics they use for many points:

- • Limiting risk and market impact.

- • Execution enhancement.

- • Price improvements.

- • Allowing privacy.

However, the differences which make our solution the best option for our customers are:

- • Execution algos are customizable not only in terms of the configuration parameters, but also through the routing of the algo.

- • Smart orders are back testable which means that customers can use the algos on their simulations and measure the improvements before even moving to the live trading.

Samples

Peg

Place orders on the passive side of the order book, move with the quote to stay on the most competitive level without reaching the best quote itself.

Hit

Place orders on the active side of the orderbook, take all the shares at that price or better to fill the order and moves with the quote to stay at most competitive cross level.

Vwap

Minimize slippage relative to the Volume Weighted Average Price in the market over a specified time horizon.

Iceberg

Split a big order into many small orders to grab liquidity available on the order book.

Stop

Minimize risk by locking the loss.

Trailing

Maximize and protect a profit.

More to come

Systemathics is continuously enhancing the existing execution algos and proposing new ones.

We are also working on the next generation of execution algos which will be cloud-based, allowing simulation and backtesting on the cloud.